APL, part of CMA CGM, plans to add a second vessel to its Guam Saipan Express (GSX) service, thus upgrading it from fortnightly to weekly. The first sailing of the weekly service commenced in late December 2016 from Yokohama, Japan. The service had employed a 1,100 TEU containership, the 13,764gt/2001 built APL Guam (above), and she was joined by the 1,600 TEU APL Saipan. On 18th November APL revealed a new India East Coast Express (IEX) service, a weekly service which directly connects the North Asia markets of Korea and China to Chennai, India. Designed with competitive transit times, the new IEX service offers a comprehensive coverage of the China market with 3 port calls in Qingdao, Shanghai and Shekou. The IEX service will call at the ports of Busan, Qingdao, Shanghai, Shekou, Singapore, Port Klang (West), Manila and Chennai and the first sailing commenced from Busan on 15th December 2016.

CMA CGM had paid off its $1.7 billion NOL acquisition loan by 21st November through sale and leaseback deals involving both ships and containers. The French company revealed that the money had been fully repaid ahead of maturity when posting a net loss of $268 million for the third quarter of 2016 as freight rates remained under pressure. Excluding the contribution of newly acquired NOL, the group recorded a $202 million loss, against a small $51 million profit a year earlier. The full reorganisation of CMA CGM and APL services will be completed next April when the new Ocean Alliance starts up with the enlarged French line teaming up with Cosco Shipping, Evergreen and OOCL. That will replace the existing Ocean Three consortium as current member UASC becomes part of the Hapag-Lloyd group and joins The Alliance, which will also begin joint operations from April.

On 17th November CMA CGM announced the new REX3 service connecting Djibouti, Saudi Arabia, Egypt, Jordan, Singapore and China. In addition to the calls offered by the REX2, MEX1 and EPIC lines, CMA CGM now operates an additional stop on the REX3 service. Djibouti is the entrance port to the Ethiopian market and will now be directly connected with Asia and Jeddah, a strategic port for exports to the U.S.A. The service is operated in partnership with APL through a swap agreement and will offer the following port rotation: Shanghai, Ningbo, Nansha, Shekou, Singapore, Djibouti, Jeddah, Sokhna, Aqaba, Djibouti, Singapore, Ningbo and Shanghai.

On 22nd November CMA CGM and CNAN NORD Spa, the Algerian National Shipping Company, announced that they had signed a co-operation agreement on 8th November. The agreement focuses on 3 strategic axes: Operational co-operation for a common shipping line linking Northern Europe to the Algerian ports; Operational and logistic co-operation between CMA CGM and CNAN NORD Spa (space allocation aboard oceanic CMA CGM vessels, provision of containers etc) and sharing of expertise between CMA CGM and CNAN NORD Spa regarding the training of seafarers and executives. The following week CMA CGM announced an improved service directly connecting North Europe with Central America. The enhanced ECS service will provide one of the shortest transit times on the market, linking Rotterdam from Costa Rica in only 14 days and adding London as a port of call in 15 days. Offered in co-operation with Hapag-Lloyd, the service will be operated by five state of the art CMA CGM vessels with a 2,300 TEU capacity and 550 reefer plugs and one Hapag-Lloyd vessel. The first vessel arrived at London Gateway on 6th January 2017. The new rotation will be: Puerto Limon, Kingston, Rotterdam, London, Hamburg, Antwerp, Le Havre, Caucedo, Kingston, Santo Tomas de Castilla, Puerto Cortes and Puerto Limon.

Starting 16th December, CMA CGM chose to revamp its feeder network to the Indian Ocean to reinforce its quality, reliability and frequency. The offering of two separate products dedicated to the Comoros/Mozambique market and North Madagascar will strengthen their competitiveness.

The new Indian Ocean Feeder Loop 3 service, deploying 1 vessel of 618 TEU, will be exclusively dedicated to Comoros and Nacala, Mozambique, via Longoni hub (Mayotte). The primary features of this include improved frequency to Moroni and Mutsamudu, offering fortnightly calls with a gain of 7 days transit time. The current Comoros call on the Indian Ocean feeder will be discontinued as from the call of the Kiria. The last call to Moroni was on 6th December and Mutsamudu on 9th December. The Nacala call on the Swahili service stopped from 9th December with the call of the 16,803gt/2000 built CMA CGM Okapi (above). The new Indian Ocean Feeder Loop 3 service port coverage is Longoni- Mutsamudu-Moroni-Nacala-Longoni.

A new ADRIMED Express service was announced on 1st December, directly linking the ports of the Adriatic Sea and Egypt (Egypt, Malta, Croatia, Italy, and Slovenia).

The service is especially designed for perishable goods transportation in reefer containers and offers the best transit times on the market between the Adriatic Sea and Egypt. Three 2,800 to 3,500 TEU-capacity vessels operate the following rotation: Rijeka, Trieste, Venice, Koper, Malta, Damietta, Alexandria, Malta and Rijeka.

COSCO Shipping Holdings, the containership and port arm of China Cosco Shipping Group, has announced a series of acquisitions via connected transactions, a move that looks to consolidate and streamline its overseas operations. CSH, via two of its subsidies, will purchase equity stakes in five affiliated firms abroad, mainly engaged in container and bulker shipping agency business, for $10.5 million.

The transactions include Cosco Container Lines Europe acquiring a 70% stake in Cosco Greece from Cosco Europe, whilst New Golden Sea Shipping will purchase a 60% stake in Cosco (India) Shipping from Cosco Holding Singapore. The deals are pending approvals from the State-owned Assets Supervision and Administration Commission of the State Council and other supervisory government departments.

Hanjin Shipping has sold two container ships for demolition, namely the 5,302 TEU/65,643gt/1997 built Post-Panamax Hanjin Paris and the 4,024 TEU/51,754gt/1997 built Panamax Hanjin Los Angeles (above). The duo was sold for $294/LTD and $289/LDT respectively. Hanjin Shipping’s fate will now be decided from 3rd February rather than 23rd December as originally planned. The court decided to give Hanjin’s accountants, Samil Price Waterhouse Coopers, extra time to assess the company’s finances. Korea Line Corp. has paid $31.4 million to take over Hanjin Shipping’s transpacific assets, a deal which includes five containerships but not a stake in a terminal in Long Beach, California, as originally outlined when Hanjin first put these assets on the market. Korea Line specialises in bulk carriers and beat Hyundai Merchant Marine to the $31.4 million purchase, to be completed on 5th January. Under the deal, 574 employees of Hanjin Shipping will transfer and work for Korea Line.

Hamburg Süd announced as December got underway that Maersk Line A/S and the Oetker Group had reached an agreement for the Danish line to acquire the German container shipping operator, full name Hamburg Südamerikanische Dampfschifffahrts- Gesellschaft KG. The eight Oetker siblings who own Hamburg Süd had been considering whether or not to remain in shipping for a while. Hamburg Süd is ranked number seven in the world with a 130-strong container ship fleet with a collective capacity of 625,000 TEU. The Oetker Group, headed by Richard Oetker, was keen to avoid a repeat of the past, when merger negotiations with Hapag- Lloyd collapsed on two occasions, partly because of differences over who would be in charge of the enlarged line. Hamburg Süd does not publish profits, but said earlier in 2016 that turnover was up almost 17% in 2015 to €6 billion, helped by the acquisition of CCNI, while volumes rose more than 21% to 4.1 million TEU. Hamburg Süd has 5,960 employees in more than 250 offices across the world and markets its services through the Hamburg Süd, CCNI, based in Chile, and Aliança, based in Brazil, brands.

In 2015, Hamburg Süd had a turnover of $6,726 million of which $6,261 million stems from its container line activities. With the acquisition of Hamburg Süd, Maersk Line will grow its global capacity share to approximately 18.6% (now 15.7%), its nominal capacity to around 3.8 million TEU (now 3.1 million TEU) while decreasing the average age of the combined fleet of more than 700 vessels to 8.7 years compared to Maersk Line’s present vessel age of 9.2 years.

Hapag Lloyd’s merger with United Arab Shipping Company (UASC) was given conditional approval on 23rd November by the European Commission. However, UASC will need to cut some of its routes to win full EC approval. UASC will need to withdraw from a consortium on the trade routes between Northern Europe and North America, where the merged entity would have faced insufficient competitive constraint.

Hyundai Merchant Marine (HMM) had been negotiating for five months on the possibility of joining the world’s largest alliance 2M but, according to reports, in November the parties (Maersk/MSC/HMM) decided “to look at other co-operation possibilities.” The parties “discussed the possibility of HMM joining 2M as an operating partner,” according to a spokesperson from Maersk Line, however, the talks shifted to the possibility of HMM partnering with the 2M network through a slot exchange and purchase agreement. Then, on 1st December, it was revealed that HMM was destined to join the 2M Alliance. Reports indicated that negotiations were likely to be completed by 10th December. However, in another twist, talks were held as from 5th December in a “make or break” attempt to secure HMM’s place in the 2M Alliance.

JR Shipping of the Netherlands has purchased four Hamburger Lloyd feeder containerships in an en-bloc transaction worth a total of $30 million. The 16,324gt/169m long and 27.2m beam Barmbek, Eilbek, Reinbek (above) and Flottbek were all delivered by Germany’s Meyer Werft in 2005 and have a capacity of 1,638 TEU each. Hamburger Lloyd’s fleet is a mix of containerships, chemical carriers and bulk carriers and was formed from the merger of Wappen Reederei and Reederei Hamburger Lloyd.

Maersk Lines’ 50,869gt/2011 built and 4,496 TEU capacity containership Maersk Cotonou (above) was attacked by supposed criminals attempting to board the vessel off the Nigerian coast on 19th November. The ship was en-route to Walvis Bay, Namibia and the ship applied counter piracy measures rendering the attack unsuccessful. The attempt is believed to have been carried out by the same pirates who tried to attack an inbound convoy earlier the same day.

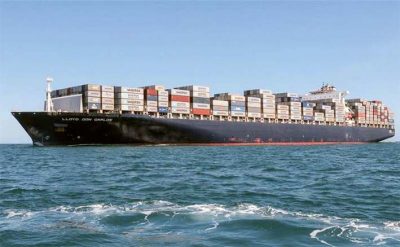

The Maersk Line operated 91,649gt/ 2006 built and 8,533 TEU capacity Lloyd Don Carlos (above) became the first ship of her size and capacity to call at Australia’s Port of Brisbane. The ship exchanged approximately 700 containers, discharging empty refrigerated containers and loading chickpea container exports whilst berthed at Patrick Terminals. Brisbane facilitates the majority of Queensland’s international containerised trade and in 2015/16, the port’s container trade grew to more than 1.14 million TEUs, led by full import containers which grew 1.7% on the previous year.

MSC launched a new service, the Sequoia, on its Transpacific West Coast USA & Canada route from 9th December 2016. The Sequoia service represents MSC’s sixth Transpacific service and will connect South China with California’s Long Beach. The service started operating from Chiwan, China, using the 50,686gt/2007-built container ship Safmarine Mulanje (above). The port rotation is as follows: Chiwan, Yantian, Ningbo (China), Long Beach (US). The other five services on the company’s Transpacific route are the Pearl, Jaguar, Orient, Maple and Eagle. MSC’s New Kiwi Service has been running in its current format since February 2015, with fixed weekly port calls into Bell Bay. The company has now upgraded this with two fixed port calls in Bell Bay each week and the service is linking Tasmania directly to Noumea and New Zealand. The first vessel to call at Bell Bay via the upgraded service was the 9,957gt/2005-built Malte Rambow on 8th December. The port rotation of the New Kiwi Service will be as follows, with round trip transit times remaining unchanged: Sydney, Brisbane (Australia), Noumea (New Caledonia), Tauranga, Auckland (New Zealand), Bell Bay, Melbourne, Bell Bay, Sydney (Australia).

Pasha Hawaii of Honolulu has announced that it has narrowed its selection to two U.S. shipyards for the construction of two new LNG fuelled containerships, with the option to order two additional vessels. Contract specifications were expected to be finalised by the end of November, with the final selection decision anticipated in January 2017. The company did not name the two shipyards shortlisted. The vessels are planned to have capacity of 3,400 TEUs, including 500 45-foot containers and 400 refrigerated containers, and a sailing speed of 23 knots. Delivery of the first vessel is expected mid- 2019, with delivery of the second vessel to come in early 2020. The tender process will ensure that the newbuilds are Jones Actqualified, i.e built in the U.S.A.

Rickmers’ Singapore affiliate Rickmers Ship Management being unable to make the $4.3 million interest payment outstanding on a bond issue will have “no impact” on the finances of German owner Bertram Rickmers’ master company Rickmers Holdings, according to a statement issued by the Hamburg based company. The statement confirmed that Rickmers Holdings and its subsidiaries on the one hand and Rickmers Maritime on the other do not have any common financing structures. Their sources of finance are entirely separate from one another. The coupon-payment default on the bond issued by Rickmers Maritime does not trigger any cross-defaults or events of default under the terms of the financing structures of Rickmers Holdings or its subsidiaries. There is also no operational impact on the vessels owned by Rickmers Group.

Rickmers Ship Management may be about to set an all new record for the youngest ship being sent for scrap, at the time of writing. The 7 year old and 4,250 TEU capacity India Rickmers (40,542gt/2009) was worth a scrap value of $325 per ldt. With Panamax vessels now worth little more than scrap, 2016 has seen record volumes of containerships scrapped. If demolished, the India Rickmers will set a new record as the previous youngest ships scrapped were all built in 2006. In the first 10 months of the year a record 500,000 TEU of containership capacity was scrapped, over four times that of 2015. The third quarter of 2016 accounted for more than 41% of the total demolition in 2016 and 47% of all ships sent for demolition have been of the Panamax.

ZIM of Israel restructured and upgraded its Turkey Greece Express (TGX) and Turkey Israel Express (TIX) services in the East Mediterranean as from 28th November. The company has added the ports of Aliaga (Turkey), Damietta (Egypt), Iskenderun (Turkey) and Ashdod (Israel) to its schedule. The company is deploying two 1,600 TEU vessels on the TGX service and two 2,800 TEU ships on the TIX service.

Comments

Sorry, comments are closed for this item